Bank Register Show Deposits but Banking Review Screen Doesnt Have the Deposit

Every concern has undeposited funds. Sometimes funds are "in transit" for less than a day, as when a client pays you with cash or a check and you take the money to your banking company at the end of the day. Other times, funds might be in transit for several days. This is most mutual when yous batch your deposits — only going to the depository financial institution in one case or twice a week — or when yous take a credit card payment and it takes a twenty-four hour period or two for the funds to clear your bank business relationship.

QuickBooks Online has a special business relationship specifically for these funds in transit. Unfortunately, the Undeposited Funds business relationship in QuickBooks Online is one of the near misunderstood accounts — and one of the accounts most likely to cause a business'southward fiscal statements to be incorrect.

Here's what you need to know about QuickBooks Online's Undeposited Funds account to keep your business accounting operations running smoothly.

What is the Undeposited Funds account?

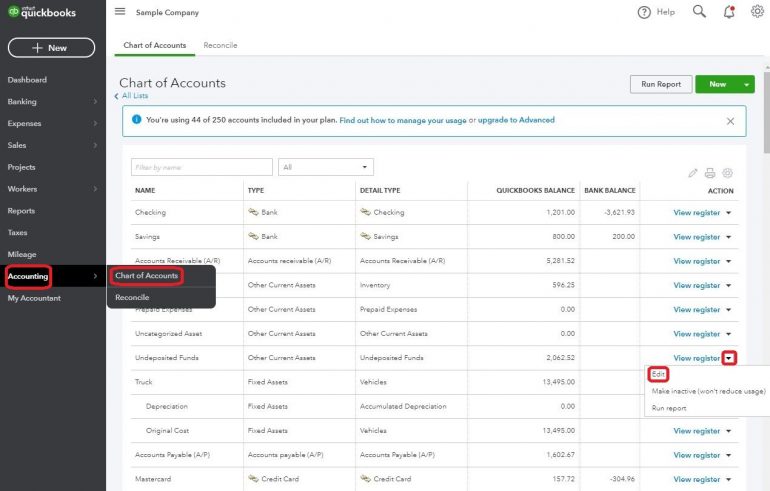

Every QuickBooks Online file has an Undeposited Funds business relationship. This account is created automatically as office of your business organisation'southward chart of accounts and cannot be deleted. If you attempt to do and so, QuickBooks Online will just create a new Undeposited Funds account for you lot.

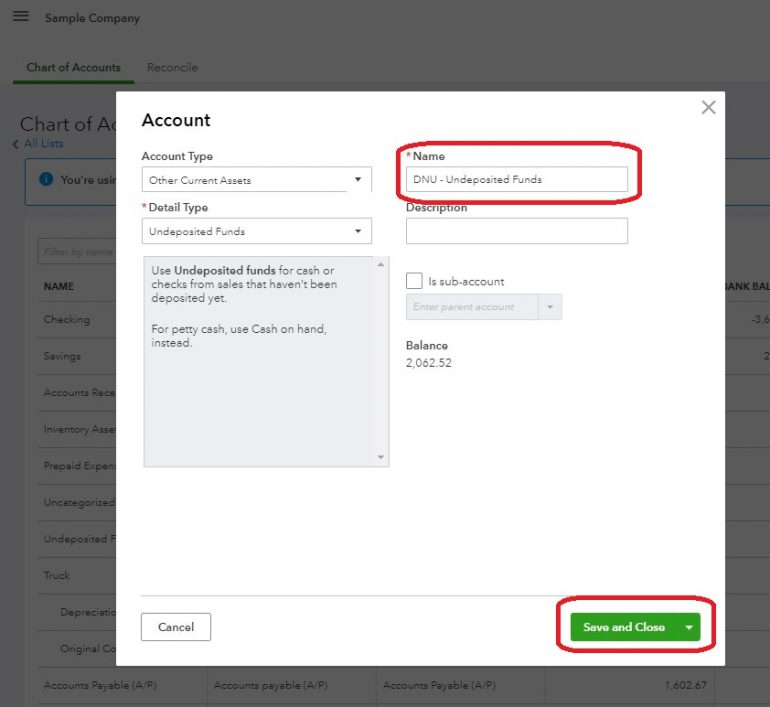

Pro tip: If you make up one's mind you don't want to employ the Undeposited Funds account in QuickBooks Online, rename the account to "Practise Not Use — Undeposited Funds" or "DNU — Undeposited Funds." This won't delete the account, merely it will requite you a visual cue to not postal service payments to this account.

The Undeposited Funds business relationship in QuickBooks Online is an "Other Current Nugget" account. A current asset is something you own that you intend to catechumen to cash (or in this example, eolith in the bank) within a yr.

In simpler terms, it's a belongings account for the money y'all take received and intend to deposit, simply you haven't deposited yet. This is different from petty cash or your greenbacks register till, which is cash you have on hand but don't intend to deposit. As you tin can encounter in the image to a higher place, QuickBooks Online instructs you to utilize the Greenbacks On Hand account instead of the Undeposited Funds account for niggling cash.

Quickbooks Online

Reasons to apply the Undeposited Funds account

1. Accurately record the date a payment was received. Permit'due south say your customer sent you a check for services rendered. You received the bank check on the concluding mean solar day of the yr, which happened to exist a Saturday.

In lodge for your financial statements to be accurate for the year, you need to record the payment as beingness received on December. 31. However, the payment volition not articulate your banking concern until Jan. 2 of the next year, at the earliest.

When you utilise the Undeposited Funds account, yous can record the date the payment was received accurately and still keep your bank account in order by really recording the eolith to the bank account on the mean solar day you brand the deposit.

2. Your eolith contains payments for multiple invoices. Chances are you will occasionally receive payments from multiple customers and batch those into one deposit. Posting these payments to the Undeposited Funds account volition allow you lot to correctly record the eolith in QuickBooks Online, making reconciling your depository financial institution account easier.

For instance, let'southward say Willie's Widgets paid you $300, Wally's Whatsits paid you lot $750 and Whitley's Whosits paid y'all $200. You batch these payments into one deposit totaling $ane,250. However, you need to properly credit each customer for their payment. Posting each payment to the Undeposited Funds business relationship and then recording the deposit in QuickBooks Online allows you to do this.

You lot can use the Undeposited Funds account with any blazon of payment: cash, check, ACH or credit card. If you lot utilise QuickBooks Payments to process your ACH and credit menu transactions, though, at that place is no need to mail the payments to the Undeposited Funds account. QuickBooks Online handles these payments backside the scenes, and y'all'll only encounter them in the Undeposited Funds account if QuickBooks Online is unable to correctly post them for you when the payment clears.

Undeposited Funds account alternative

Some QuickBooks Online users adopt to post payments direct to their banking company accounts rather than using the Undeposited Funds account. This is fine if you are posting a single payment. However, posting each payment in a deposit individually to the bank account will make it more hard for y'all to reconcile your bank statements each month, making it harder to detect bookkeeping errors and possible fraud.

Most QuickBooks Online users find it easier to always post to the Undeposited Funds account starting time, and then enter the eolith into QuickBooks Online separately. Doing this does result in an boosted step, simply memorizing ane fashion of recording payments is easier than having to retrieve multiple processes.

How to employ QuickBooks Online's Undeposited Funds business relationship

If y'all're still unsure about why you should utilise the Undeposited Funds account or how information technology works, the following step-by-step example will help.

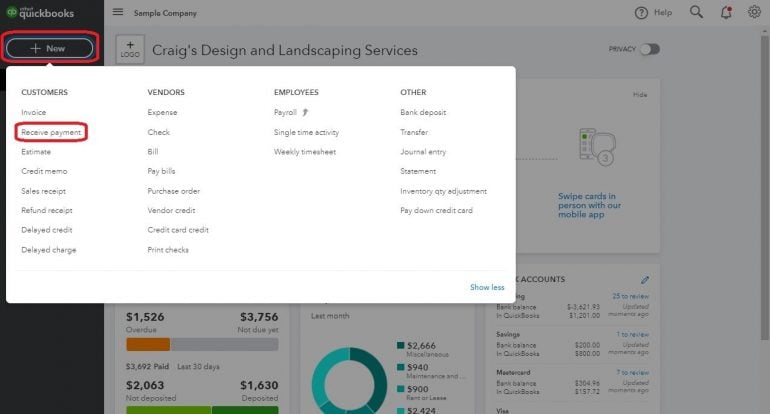

ane. Receive payments from your customers. Your customer has given y'all a payment for goods purchased or services rendered. If your customer is paying an invoice yous accept entered into QuickBooks Online and sent to them, y'all will desire to record the payment using the Receive Payments option.

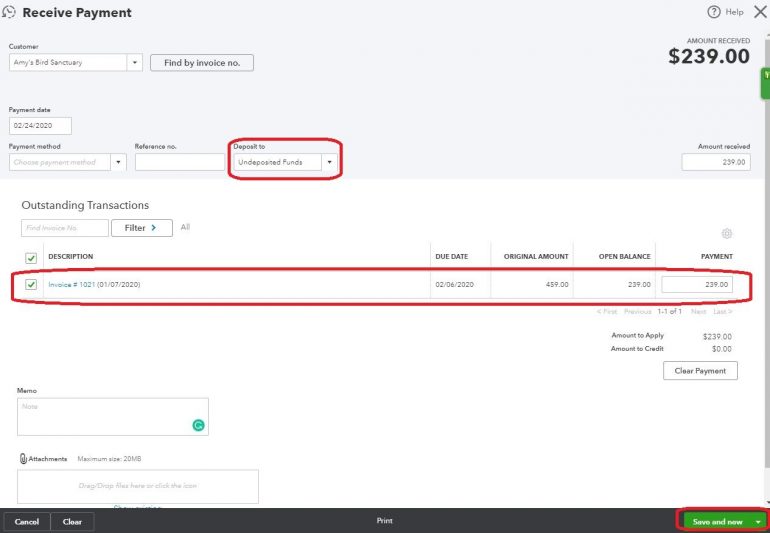

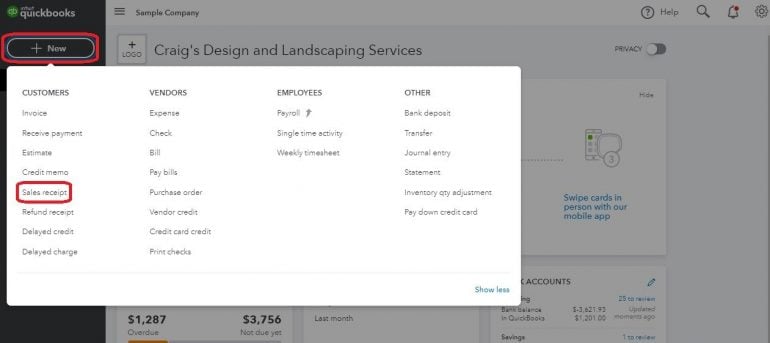

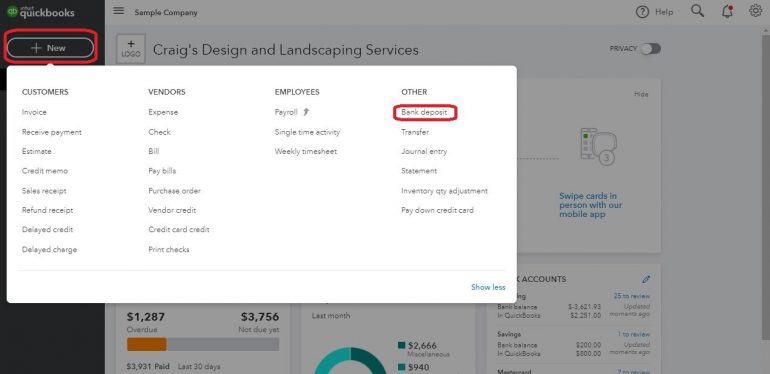

Click on the "+ New" button, then select Receive Payment.

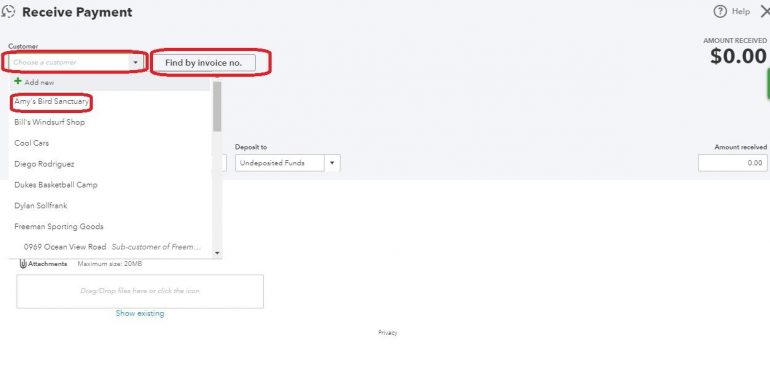

Cull the client from the drib-downwards menu. You tin can also search by invoice number instead of customer name.

At present, select the invoice or invoices the customer paid. Brand certain you select Undeposited Funds from the "Eolith To" drop-down menu, then relieve the transaction.

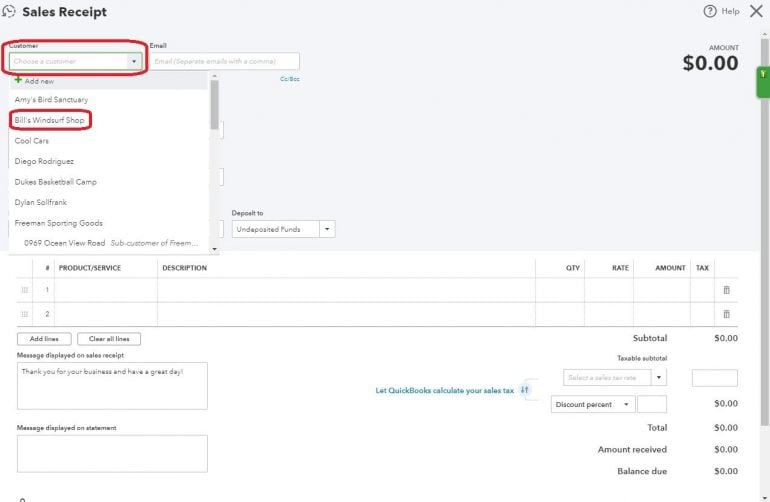

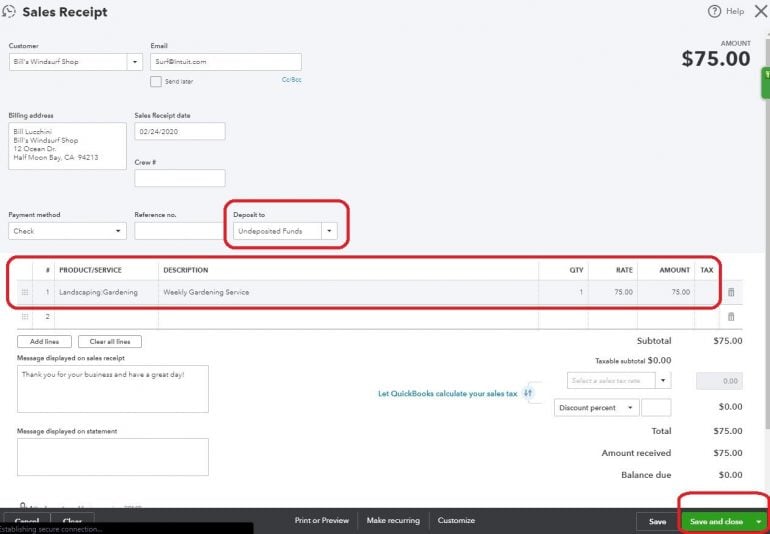

If your customer paid you when they made the purchase — meaning y'all didn't send them an invoice for payment at a later date — enter a sales receipt instead.

Again, make certain yous are selecting Undeposited Funds from the "Eolith To" driblet-down carte, and save the transaction.

Continue inbound payments received from your customers until all payments have been entered.

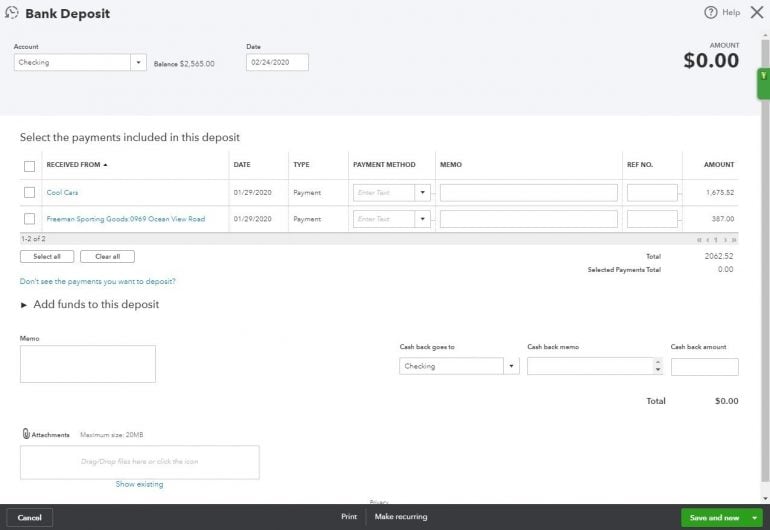

2. Create the deposit in QuickBooks Online.

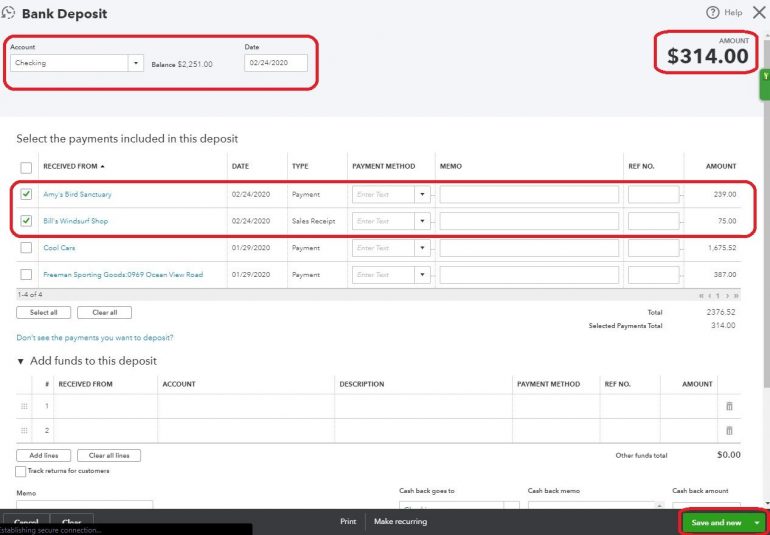

Select all the payments you will include in the deposit, making sure the amount yous tape in QuickBooks Online matches the amount on your bank deposit slip. Also, be sure you are posting the eolith to the right account — in this case, checking — and that the date on the transaction is the appointment you will accept the deposit to the bank. Then, relieve the eolith.

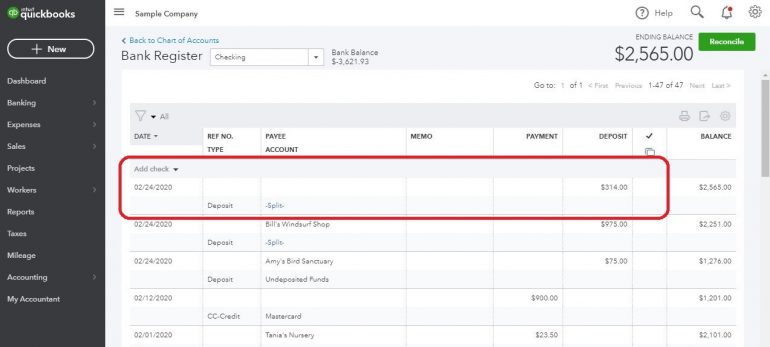

iii. Check your work. Now, when you check the Bank Register for your checking account, you can see the deposit posted for the right amount.

It appears as a "Split" transaction because the deposit is made up of multiple payments.

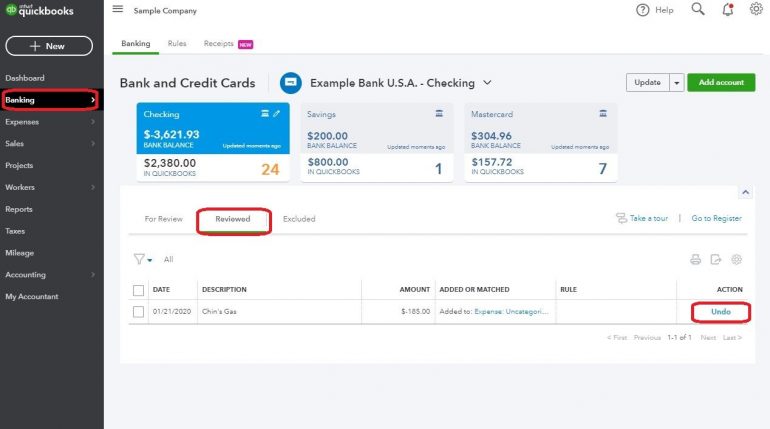

four. Reconcile the transaction. When the deposit clears the bank, you will be able to match the deposit in your bank feed. If you don't use the bank feed function in QuickBooks Online, you volition still be able to easily reconcile the deposit when you get your bank statement.

Keeping the Undeposited Funds account authentic

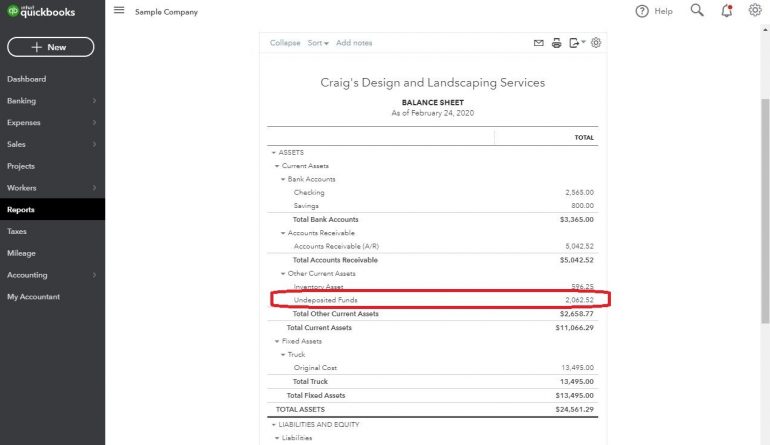

The "normal" balance for the Undeposited Funds account is $0. If y'all see a residue in Undeposited Funds on your residual sheet, you need to investigate.

First, reconcile your bank accounts to make certain you accept recorded all the deposits y'all have made. One time yous have adamant all deposits take been recorded properly, open up the Banking company Deposit screen once more and review what is in the Undeposited Funds account.

In this example, ii transactions make up the $2,062.52 balance.

Since both transactions were dated on January. 29, the showtime thing to check for is a deposit in your Banking concern Register for $2,062.52 dated on or around Jan. 29. It's possible the deposit was posted straight to an Income account rather than matched to payments received. Also check for two separate deposits for $1,675.52 and $387, respectively.

If you find that the deposit was posted straight to Income in the bank feed , united nations-reconcile the transaction, undo the entry so match the transaction properly. So, reconcile the transaction again.

This troubleshooting process tin take some time, but it resolves nigh incorrect balances in the Undeposited Funds account.

Why a journal entry won't work

Some accountants or bookkeepers who don't understand the full functionality of QuickBooks Online might try to fix incorrect balances in the Undeposited Funds account with a periodical entry. Although this will remedy the wrong account balance on the residuum sheet, it will non clear the undeposited transactions from the Bank Deposit screen.

If y'all have a large number of transactions in the Undeposited Funds business relationship, or if the transactions extend into previous years, enlist the help of a bookkeeper who understands QuickBooks Online and how to properly resolve transactions in the Undeposited Funds account. Otherwise, you run the risk of either understating or overstating your income, both of which volition have tax implications.

QuickBooks Online resources

Read more than almost how QuickBooks Online works.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

conversewoned1940.blogspot.com

Source: https://www.nerdwallet.com/article/small-business/undeposited-funds-in-quickbooks-online

0 Response to "Bank Register Show Deposits but Banking Review Screen Doesnt Have the Deposit"

Post a Comment